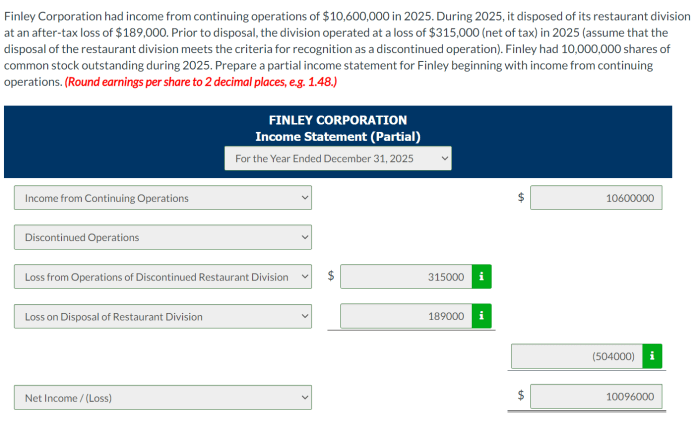

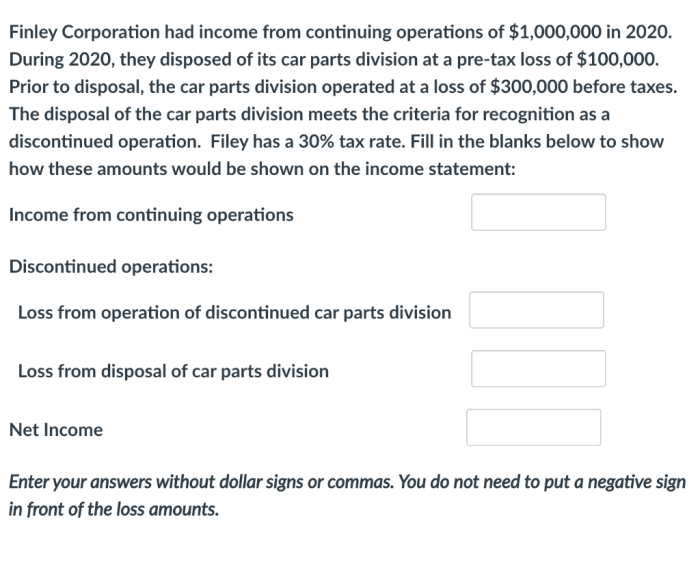

Finley corporation had income from continuing operations of – Finley Corporation’s income from continuing operations, a crucial metric for assessing a company’s financial performance, provides valuable insights into its ongoing business activities. This comprehensive analysis will delve into the significance, presentation, and impact of income from continuing operations, distinguishing it from other income sources and exploring industry comparisons and trend analysis.

The following paragraphs will provide a detailed examination of income from continuing operations, its role in financial statement analysis, and its implications for industry benchmarking and trend identification.

Income from Continuing Operations Overview

Income from continuing operations is a crucial financial metric that reflects a company’s core business activities and provides insights into its ongoing profitability. It excludes income and expenses from discontinued operations or other non-recurring events.

Income from continuing operations is defined as the net income generated by a company’s primary business activities, excluding extraordinary items, discontinued operations, and other non-operating income and expenses.

Examples of activities that contribute to income from continuing operations include:

- Sales of products or services

- Interest income from operating assets

- Rent income from operating properties

Financial Statement Presentation

Income from continuing operations is typically presented on the income statement as a separate line item between operating expenses and other income.

It is classified as a component of net income, which represents the company’s overall financial performance.

Examples of how income from continuing operations is reported in financial statements include:

- “Income from continuing operations before income taxes”

- “Income from continuing operations after income taxes”

Impact on Financial Analysis, Finley corporation had income from continuing operations of

Income from continuing operations is a key metric for financial analysts to assess a company’s financial performance and stability.

It is used to calculate financial ratios such as:

- Operating profit margin

- Earnings per share

- Return on equity

These ratios provide insights into a company’s profitability, efficiency, and financial leverage.

Distinguishing from Other Income

Other income is defined as income that arises from non-operating activities, such as:

- Gains on asset sales

- Dividend income from investments

- Foreign exchange gains

Distinguishing between income from continuing operations and other income is crucial because other income can be volatile and non-recurring, while income from continuing operations reflects the company’s core business activities.

Trends and Analysis

Analyzing trends in income from continuing operations is essential to understand a company’s financial performance over time.

Positive trends indicate growth and stability, while negative trends may signal challenges or declining profitability.

Trend analysis can provide insights into:

- The company’s ability to generate consistent profits

- The impact of seasonality or economic cycles on the business

- The effectiveness of management strategies

Industry Comparison

Comparing income from continuing operations across different industries provides insights into a company’s competitive position.

Industry benchmarks can be used to assess whether a company is performing in line with its peers or if there are areas for improvement.

Examples of industry benchmarks include:

- Average operating profit margin

- Median return on equity

- Industry growth rate

Commonly Asked Questions: Finley Corporation Had Income From Continuing Operations Of

What is the significance of income from continuing operations?

Income from continuing operations represents the core earnings of a company, excluding discontinued operations and other non-recurring events. It provides insights into the company’s ongoing business performance and its ability to generate revenue from its primary activities.

How is income from continuing operations presented in financial statements?

Income from continuing operations is typically reported as a separate line item on the income statement, after deducting expenses and other income. It is often presented as “Income from Continuing Operations” or “Operating Income.”